Source: The New York Times

In the United States, starter homes have traditionally been a popular option for first-time homebuyers. These smaller, more affordable homes have been a stepping stone for many families to enter the housing market and build equity. However, in recent years, the availability of starter homes has declined, and many potential homeowners are finding it increasingly difficult to purchase their first property. In this article, we will explore what has happened to starter homes in the USA and the factors that have contributed to their decline.

What Are Starter Homes?

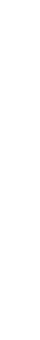

Before we dive into the issues facing starter homes, it’s important to define what they are. A starter home is a smaller, less expensive home that is typically bought by first-time homebuyers. These homes are often located in suburban areas and may have fewer amenities than larger, more expensive properties. Starter homes are typically less than 1,500 square feet and are priced below the median home price for a given area.

Traditionally, starter homes were smaller single-family homes, often located in suburban areas. These homes were often in need of some repairs or renovations, but they were priced low enough that young homeowners could afford to fix them up over time. Starter homes were an essential part of the “American Dream”, offering young people the opportunity to build wealth and put down roots in their community.

What Happened to Starter Homes?

Source: CNS News

Despite the enduring appeal of starter homes, they have become increasingly rare and difficult to find in recent years. There are several reasons for this.

First, the housing market has changed dramatically over the past few decades. In the 1980s and 1990s, it was relatively easy for young people to purchase a starter home. Home prices were lower, and mortgage interest rates were much more reasonable. In addition, there was a surplus of small, affordable homes on the market, giving young people plenty of options to choose from.

However, in the early 2000s, the housing market underwent a significant transformation. Home prices skyrocketed, particularly in desirable suburban areas. Meanwhile, wages stagnated, making it more difficult for young people to afford a home. In addition, the 2008 financial crisis made it more difficult for people to obtain mortgages, further limiting the pool of potential buyers.

Another factor that has contributed to the decline of starter homes is the rise of the luxury home market. In recent years, there has been a significant increase in the number of luxury homes being built, particularly in urban areas. These homes are often very large and very expensive, catering to a wealthy clientele.

This shift has had a ripple effect on the housing market. As more luxury homes are built, there is less demand for smaller, more affordable homes. This has led to a shortage of starter homes, particularly in desirable areas. In many cases, young people are forced to either rent or purchase a home that is much larger and more expensive than they would prefer.

In recent years, the availability of starter homes has declined significantly in the USA. According to data from the National Association of Realtors (NAR), the percentage of homes sold that were considered starter homes dropped from 38% in 2013 to just 29% in 2019. This decline is concerning for several reasons. For one, it means that fewer people are able to enter the housing market, which can have long-term economic consequences. Additionally, it can create challenges for current homeowners who are looking to sell their starter homes and move up to larger properties.

So, what has caused this decline in starter homes? There are several factors at play, including:

- Rising home prices

Perhaps the biggest factor contributing to the decline of starter homes is the rising cost of housing. In many parts of the country, home prices have increased significantly in recent years, making it more difficult for first-time buyers to afford a home. According to the NAR, the median existing-home price in January 2021 was $303,900, up 14.1% from January 2020. This increase in prices has made it more difficult for buyers to find homes that fit within their budget, especially in areas with high demand.

- Inventory shortages

Another factor contributing to the decline of starter homes is a shortage of inventory. Many areas of the country are experiencing a shortage of homes for sale, which can make it difficult for first-time buyers to find a property that meets their needs. This shortage of inventory can create bidding wars and drive up prices, making it even more difficult for first-time buyers to enter the market.

- Slow home construction

In addition to inventory shortages, the pace of home construction has been slow in recent years. According to data from the U.S. Census Bureau, the number of new housing starts in January 2021 was 1.58 million, down 6% from December 2020. This slow pace of construction can limit the number of new starter homes being built, which can make it more difficult for first-time buyers to find a property that meets their needs.

- Student loan debt

Another factor that may be contributing to the decline of starter homes is student loan debt. Many young people are graduating from college with significant amounts of debt, which can make it more difficult for them to save for a down payment on a home. According to data from the Federal Reserve, the total amount of outstanding student loan debt in the USA was $1.7 trillion in 2021, up from $1.5 trillion in 2019. This debt can make it more difficult for first-time buyers to save for a down.

What Does This Mean for Future Home Ownership?

The decline of starter homes has significant implications for the future of homeownership in the United States. For one thing, it makes it more difficult for young people to enter the housing market. Without affordable starter homes, many young people are forced to rent or delay homeownership altogether.

This has long-term consequences for wealth-building and financial stability. Homeownership is one of the most reliable ways to build wealth over time. Without the opportunity to purchase a starter home, many young people will miss out on the chance to build equity and accumulate wealth.